Reconciliation Overview

The reconciliation processes can be easily set up to compare positions and executions in PropReports against what was processed by your clearing firm or DMA platform. This is useful to identify discrepancies such as:

- Missing data

- Unprocessed corporate actions

- Away trades

- Option assignments

- Trade breaks

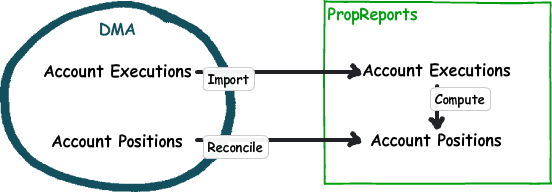

PropReports Positions vs DMA Platform

If your trading platform can create an end-of-day position file, it can be used to reconcile positions in PropReports. A separate reconciliation process can be set up for each DMA platform. Please Note: if you are combining activity from multiple trading platforms into a single PropReports account, this type of reconciliation will not be possible.

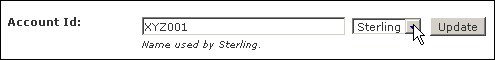

![]() Important: All accounts undergoing reconciliation vs the DMA platform must have the correct Account Id and Source set. If you are combining activity from multiple trading platforms into a single PropReports account, this type of reconciliation will not be possible.

Important: All accounts undergoing reconciliation vs the DMA platform must have the correct Account Id and Source set. If you are combining activity from multiple trading platforms into a single PropReports account, this type of reconciliation will not be possible.

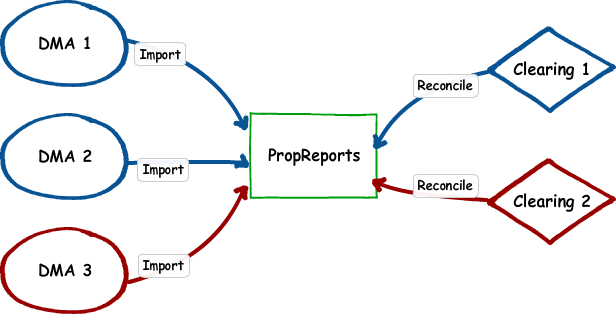

PropReports Executions and Positions vs Clearing Firm

You can also configure PropReports to compare executions and positions against what was processed by your clearing firm. Multiple clearing relationships and DMA platforms are supported as well as trade bunching and aggregation into one or more master account. When running an executions reconciliation, PropReports will compare the prices, symbols and quantities and report any discrepancies between the systems. Reconciliation of fees is not currently supported.

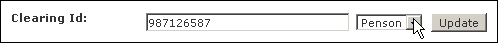

![]() Important: All accounts undergoing reconciliation vs the Clearing Firm must have their correct Clearing Id and Clearing Firm set.

Important: All accounts undergoing reconciliation vs the Clearing Firm must have their correct Clearing Id and Clearing Firm set.

Related topics:

Interpreting Reconciliation Reports

Common Execution Discrepancies