Tape Designations

Every US equity has a Tape designation, which is dependent on which stock exchange they are listed on. There are three major tapes in the United States: Tape A,Tape B and Tape C.

| Tape | Description |

|---|---|

| Tape A | Contains stocks listed on the NYSE exchange. |

Tape B | Contains stocks listed on the NYSE (AMEX) exchange and regional exchanges. |

| Tape C | Contains stocks listed on the NASDAQ exchange. |

Understanding How the Tape Effects Your Trading

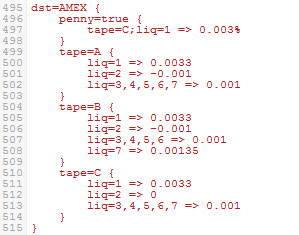

A symbols tape designation is important because ECN rates can be different in some cases, depending on what tape they are listed on. If you are interested in understanding exactly how a security's tape designation is used, please read the example below of a previously released ARCA fee schedule:

![]() Please note the figures used below are for this example only and do not reflect current ARCA rates.

Please note the figures used below are for this example only and do not reflect current ARCA rates.

For Tape A and C securities, the rebate is $0.23 for orders that add liquidity and the fee is $0.29 for orders that remove liquidity. For Tape B securities, the rebate is $0.22 for orders that add liquidity and the fee is $0.30 for orders that remove liquidity. The routing fee for Tape B and Tape C securities is $0.35 for orders executed by another market center or participant. In Tape A securities, the routing fee is $0.30 for orders executed by another market center or participant, except on the NYSE where the routing fee is $0.10

Trade Fee Schedules

Below is a screenshot of a fee schedule in PropReports that shows how ECN fees are often dependent upon the securities tape:

Related Topics / How to