Stock Split

A split is a corporate action in which a company's existing shares are divided into multiple shares. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts.

For example, in 2011, Citigroup (C) conducted a 10:1 reverse split, each stockholder had a reduction in the number of issued shares by a ratio of 10:1

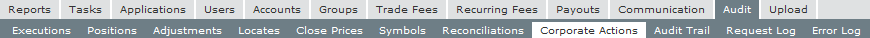

Updating Positions Effected by a Stock Split

Step 1: Navigate to the Audit / Corporate Actions page.

Step 2: Enter the Symbol, Ratio, Action Date, and New Symbol (if necessary).

Step 3: Preview the results to view all open positions on the action date and click save.

Option Split

When completing a stock split for a symbol, if there are any options with the same underlying symbol, the tool will populate preview entries for those options also.

Logic used for option split entries:

- A new option symbol is created with the strike price adjusted by split ratio

- Quantity multiplied by split ratio

- Avg Price divided by split ratio

- The new symbol Multiplier will be the standard 100 used for options. You can edit this if it needs to be changed to a different multiplier.

Example of AAPL 4-1 split on 2020-08-28 :

- 1 contract of +AAPL210115C00370000 (Apple Jan 15, 2021 $370 Call) at $1 average price

becomes...

- 4 contracts of +AAPL210115C00092500 (Apple Jan 15, 2021 $92.50 Call) at new average price of $0.25

![]() Important: The logic above should be appropriate for the WHOLE ratio option splits (5 for 1, 4 for 1, etc), but the generated entries may NOT be correct for ODD ratios split (3 for 2, 5 for 4, etc). In those cases, you'll need to review the official OCC directions to see how they handle the option split, and adjust the entries accordingly. You can search The OCC Information Memos for proper handling of option corporate actions.

Important: The logic above should be appropriate for the WHOLE ratio option splits (5 for 1, 4 for 1, etc), but the generated entries may NOT be correct for ODD ratios split (3 for 2, 5 for 4, etc). In those cases, you'll need to review the official OCC directions to see how they handle the option split, and adjust the entries accordingly. You can search The OCC Information Memos for proper handling of option corporate actions.

Related Topics / How To