Short Sales

Understanding the Short Sales Report

Abusive short selling, including certain types of naked short selling, are considered securities fraud because they can drive down stock prices. In abusive short selling, a stock is sold without being borrowed and without any intent to borrow. Because abusive shorting may drive down a stock's price, there are specific regulations traders must abide by.

The Short Sales report in PropReports is designed to alert your firm if traders are in violation of specific compliance regulations:

Agg Unit

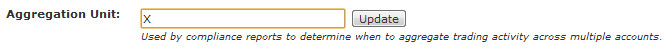

The "Agg Unit" column stands for "Aggregation Unit". If the account is enabled for compliance reporting, it may be assigned an "Aggregation Unit" on the Accounts / Overview page:

Assign the same aggregation unit name to accounts that are part of a single aggregation unit so the trading activity is reviewed in aggregate across these accounts for this report.

Violations

Mismarked Short Sales

A mismarked short sale occurs when a trader is holding a long position and uses a short order to cover the position instead of a sell order.

For example, a trader is holding 100 shares long of stock XYZ and shorts 200 shares, the 200 short execution must branch into two separate orders - 100 sell and 100 short, if the platform or the trader him/herself does not branch the order, it will appear as a mismarked short sale.

Some DMA platforms will account for this and although the order may appear as a short in your trading blotter, will route to a sell order at your broker / dealer or clearing firm.

Locate Overage

Because a short sale entails a seller selling a security it does not own, traders are required to have reasonable grounds to believe that the security could be borrowed and available for delivery before accepting or effecting a short sale order. If a stock's shares are limited and obtaining shares requires a "locate", he/she may not exceeded the allotted locate quantity.

For example, if a trader locates 1000 shares, but shorts 2000, he/she will be in violation. If a violation is confirmed, there may be a fine pursuant to firm policy.