Understanding the Fees by Destination Report

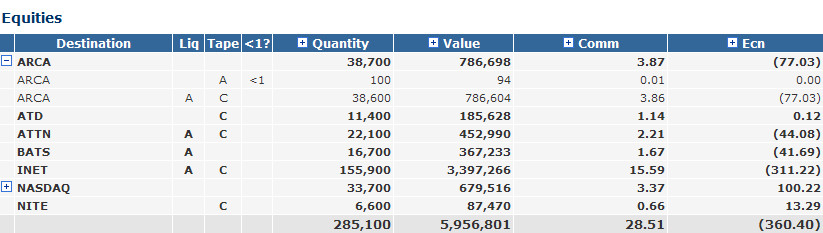

This report gives a quantitative overview of your fees by destination. By reviewing the complete trading fee costs of each destination you use, you can strategically modify your trading style to lower trade fee costs and improve your profits.

The Columns and Their Meanings

| Column | Description |

|---|---|

| Destination | The ECN used for the transaction of a security. |

| Liq | Shows the liquidity flag of the execution. The liquidity flag will tell you if are a a liquidity taker or a liquidity provider, and also let you know if your trades are earning you liquidity rebates or costing you access fees. Please visit our Liquidity Flags support site for more information. |

| Tape | The US equity tape designation. Visit our Tape Designations support site for a complete breakdown on how a US equities tape designation can effect your trading. |

| <1? | Because sub one dollar ($1.00) securities can have different fee schedules than securities priced above one dollar, a "<1" icon will appear in this column if the security traded by this destination was a penny stock. If the security was priced over one dollar, the column will be blank. |

| Quantity | Total volume of shares bought and sold using a specific route. |

| Value | The "Value" column displays the combined bought and sold cash value of the transaction. For example, a 100 share buy of security BAC @ $10 / share and a 100 share sell of security BAC @ $10 / share would equal a 2000 dollar value ((100 x 10) + (100 x 10) = 2000). |

| Fee | Expanding a Fee column such as Ecn, Comm, etc will display the amount, rate and value %.

|

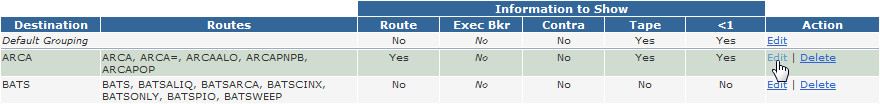

Edit Destination Grouping

Click "Edit Destination Grouping" to review and edit what routes will appear under a single alias. For example, if you have access to a diverse number of routes for different order types, you may want them to appear on the report under a single destination.

Add or remove different routes by clicking the Edit link, as seen in the screenshot below: