Fee rules are a concise way to specify an ECN fee schedule or any other schedule that contains a large number of conditional fees.

How the Rules Work

- Rules are processed first to last for every execution.

- The first rule in the list that matches determines the fee.

- If no rule matches, the fee received from the data source is left unchanged.

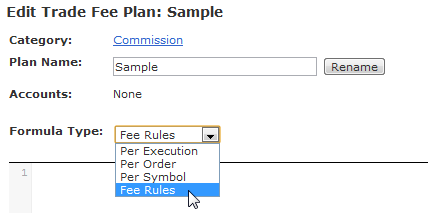

![]() Important: Make sure the Formula Type is set to "Fee Rules" when creating a plan.

Important: Make sure the Formula Type is set to "Fee Rules" when creating a plan.

Creating a Rule

Below is a sample rule:

route=ARCA,ARCAPOP;penny=true;liq=A => 0.003

The right-hand side specifies the fee to assess if the conditions match. Positive fees are charges, negative fees are rebates. The rule above charges $3 / 1000 shares.

Leaving the condition blank will match every trade (useful as the last rule to provide a catch-all). For example, changing the example above as follows will charge all remaining executions $5 / 1000:

route=ARCA,ARCA=,ARCAPOP;penny=true;liq=A => 0.003

=> 0.005 Conditions

Unless otherwise specified, conditions are not case sensitive and support a variety of operators: =, != (not equals), >=, >, <=, <

Name | Description | Example |

|---|---|---|

afterHours | Execution occurred on or after 4pm EST | afterHours=true |

contra | MPID / identifier of the counterparty. | contra=PFSI |

ccy | An ISO 4217 (3-character) currency of the trade. (v1.5.97.13 or greater) | ccy=EUR |

exch | Listing exchange for the security being traded (see list of exchange codes). | exch=NYQ |

| execBroker | MPID / identifier of the executing broker. | execBroker=PFSI |

| internalLiq | Indicates the actual liquidity flag when an order is routed via an order desk or another intermediary (when available). Note: This value is case-sensitive. | internalLiq=A |

| internalRoute | Indicates the actual destination when an order is routed via an order desk or another intermediary (when available). | internalRoute=EDGA |

liq | Liquidity flag (see flags for various destinations). Note: This value is case-sensitive. | liq=A |

lot | Considers quantity of trade: (ODD = if quantity < 100 on an execution) | lot=odd |

| mult | The multiplier (sometimes called "contract size" for options and "value multiplier" for futures) associated with the traded instrument and used when computing profit and loss (v1.5.97.14.13 or greater) | mult=100 |

penny | Set to true if trade is sub-dollar | penny=true |

price | Execution price. | price>2 |

qty | Quantity of the execution. (v1.5.92.18 or greater) | qty=100 |

route | Exchange, Route or ECN. Different platforms send can send different values for the same venue (e.g. Sterling: NSDQ vs Laser: ISLD). Furthermore, some platforms can indicate multiple values for the same destination (e.g. Sterling: ARCA, ARCA= to mean ARCA). | route=ARCA |

side | Buy or sell | side=buy |

source | Where PropReports received the trade from (see list of source ids). | source=1 |

subType | For equities, this will be either etf or blank | subType=etf |

symbol | Ticker symbol of the security being traded | symbol=IBM |

tape | Trade reporting facility indicator (e.g. A, B, or C). See Tape Designations. | tape=A |

type | Type of instrument being traded (equity, option, future, index, fund, fx, bond) | type=option |

underlyingSymbol | For options, the ticker symbol of the underlying security or index. | underlyingSymbol=YHOO |

underlyingType | For options, the type of the underlying security (equity, future, index) | underlyingType=index |

underlyingSubType | For options, the sub type of the underlying equity (etf or blank) | underlyingSubType=etf |

OR-ing conditions

Sometimes you may want to match more than one set of conditions. For example, let's say you want to select trades where either the destination or contra are set to ARCA. Since version 1.5.92.18 you can specify a rule as follows (please note the use of parenthesis):

(route=ARCA),(contra=ARCA) => 0.003

Fees

Positive fees are charges, negative fees are rebates. There are four ways to assess a fee or rebate:

| Method | Example |

|---|---|

| Per Share | 0.003 (1,000 shares @ $2 is charged 1,000 * 0.003 = $3.00). |

| Percentage of Value | 0.003% (1,000 shares @ $2 is charged $2,000 * 0.003 = $6.00). |

Fixed Amount per Execution (available in v1.5.92.51.3 or greater) | [10] ($10 is charged) |

| Pass Through (do not change) | blank (the fee will be left as received from the data source) |

You can also specify a minimum/maximum of two or three fees (available in PropReports v1.5.91.17 and greater):

| Example | Description |

|---|---|

| max(0.003%, 0.003) | Result will be the highest of : (0.003 * trade value) or (0.003 * quantity) |

| min(0.003%, 0.003, 3) | Result will be the lowest of : (0.003 * trade value) or (0.003 * quantity) or 3 |

Blocks

To avoid repeating the same condition you can specify blocks.

Instead of:

route=EDGA;liq=A => -0.002route=EDGA;liq=B => 0.0002You can use:

route=EDGA { liq=A => -0.002 liq=B => 0.0002}Blocks can also be nested. For example:

route=EDGA { penny=true { liq=A => -0.001% liq=B => 0.003% } liq=A => -0.002 liq=B => 0.0002}Comments

Any lines that start with a '#' are ignored. Any text following a '#' at the end of a line will also be ignored. Comments are available in PropReports v1.5.91.17 and greater.

# this Comment line will be ignoredroute=EDGA;liq=A => -0.002route=EDGA;liq=B => 0.002 # another comment that will be ignored