A split is a corporate action in which a company's existing shares are divided into multiple shares. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts.

For example, in 2011, Citigroup (C) conducted a 10:1 reverse split, each stockholder had a reduction in the number of issued shares by a ratio of 10:1

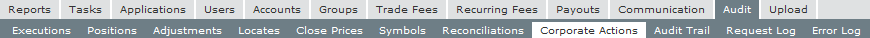

Updating Positions Effected by a Stock Split

Step 1: Navigate to the Audit / Corporate Actions page.

Step 2: Enter the Symbol, Ratio, Action Date, and New Symbol (if necessary).

Step 3: Preview the results to view all open positions on the action date and click save.

Options

When completing a stock split for a symbol, if there are any options with the same underlying symbol, the tool will populate preview entries for them.

Logic used for option split entries:

- A new option symbol is created with the strike price adjusted by split ratio

- Multiplies Quantity by split ratio

- Divides Avg Price by split ratio

Example:

1 contract of +AAPL210115C00370000 (Apple Jan 15, 2021 $370 Call) at $1 average price, becomes

4 contracts of +AAPL210115C00092500 (Apple Jan 15, 2021 $92.50 Call) at new average price of $0.25

![]() Important: The logic above should be appropriate for the WHOLE ratio option splits (5 for 1, 4 for 1, etc), but the generated entries may NOT be correct for ODD split ratios (3 for 2, 5 for 4, etc). In those cases, you'll need to review the official OCC directions to see how they handle the option split, and adjust the entries accordingly.

Important: The logic above should be appropriate for the WHOLE ratio option splits (5 for 1, 4 for 1, etc), but the generated entries may NOT be correct for ODD split ratios (3 for 2, 5 for 4, etc). In those cases, you'll need to review the official OCC directions to see how they handle the option split, and adjust the entries accordingly.

Related Topics / How To