The Trade Performance report helps you identify possible trends in your trading activity by examining your trades over a specified period of time and breaking down Wins and Losses by:

- Long vs Short

- Time of the Day (note: if a time period has no trading activity, it will not be displayed)

- Day of the Week

- Traded Security

- Instrument Type (equities, options, futures, etc)

Understanding the Trade Performance Report

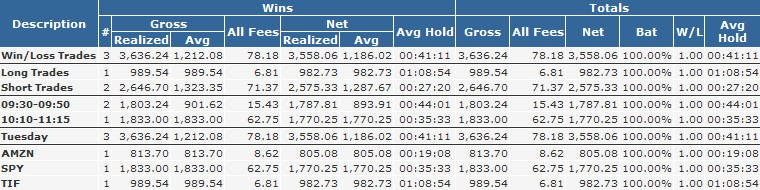

Below is a snapshot of a the Trade Performance report with sample trade data.

Statistics

| Column | |

|---|---|

| BAT | "Batting Average" is the percentage of winning trades |

| W/L | "Win / Loss Ratio" is the average net gain in winning trades / average net loss in losing trades |

| Avg Hold | "Average Holding Period" is the average period of time during which each position was held |

Completed Trades

All statistics are based on completed or "round trip" trades. A completed trade is defined as a set of transactions from the time a position is opened until the time it goes flat. For example, given the following fills:

| Date | Side | Shares | Symbol | Price |

|---|---|---|---|---|

| Monday | B | 100 | XYZ | $1.00 |

| Tuesday | S | 50 | XYZ | $2.00 |

| Wednesday | S | 50 | XYZ | $2.00 |

The Trade Performance report would calculate one trade, realizing a $100 profit, and is counted for Wednesday.

Wash Trades

A wash trade is a trade where the net profit or loss is exactly $0.00.